Many traders generally understand that it is important to limit trading risk, but realistically, most would rather focus primarily on the potential returns generated when developing their trading systems. However, the impact of drawdown is equally essential to one’s trading success.

In forex trading, drawdown refers to the difference between a high point in the balance of one’s trading account and the subsequent low point. The difference in balance reflects lost capital due to a series of losing trades. It is therefore a measure of downside volatility and is usually expressed as a percentage.

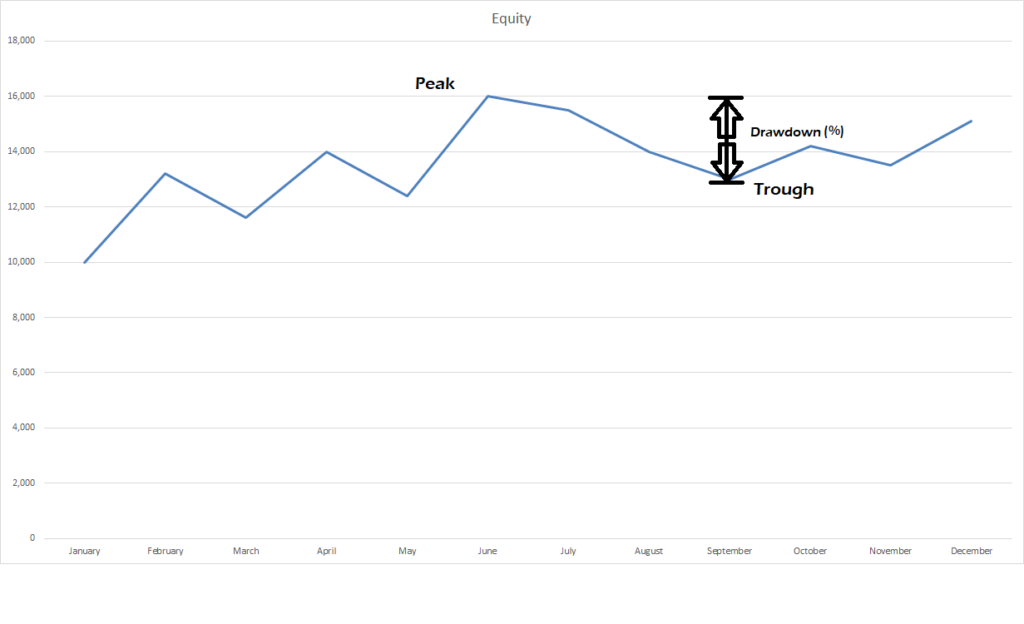

A good way to understand drawdown is by taking a look at the equity curve below:

Let’s say you open a new forex trading account in January with a starting balance of $10,000, slowly working your way up to $16,000 by June. Then you hit a rough patch and experience a series of losing months where the account balance goes down to $13,000 in September, before making its way back up again.

Essentially, the drawdown is the percentage of capital you lose before bouncing back up. This is calculated by obtaining the difference between the peak and the trough during the losing period.

The maximum value of the account from where you start to experience drawdown is called the peak ($16,000). The lowest point from which you start to recover is called the trough ($13,000). The percentage difference between the two is called the drawdown. Here, drawdown would be equal to almost 20% (18.75% to be exact).

Drawdowns in trading are extremely common and even the most profitable traders experience drawdown on a regular basis. Despite a trading strategy’s long-term profitability expectancy, drawdowns may occur as a natural function of the ups and downs of trading and, when managed properly, they should not be threatening to the overall performance of a trader. Notwithstanding their inevitability, there are some things to consider when dealing with drawdown.

Firstly, the asymmetry of drawdown recovery is one of the greatest challenges of trading. This means that the greater the current drawdown, the greater is the return required to recover to break-even.

| Drawdown | Return Required to Recover |

| 1% | 1% |

| 20% | 25% |

| 50% | 100% |

| 90% | 900% |

Let’s say you have £10,000 at your disposal for trading. As can be noted above, if you lose 1% of that (£100), the new balance will be £9,900. It would take just over 1% return to get back to £10,000 (because 1% of £9,900 is £99).

If you have a 50% drawdown, you have to make 100% on the remaining equity just to get back to break even (because to get from £5,000 to 10,000 requires a 100% return), and so on. This just shows how problems magnify as drawdown increases.

The time it takes to recover a drawdown should also be considered. So as the return required increases, so does the time it takes to do so. Unless traders endure significant risk to recoup their lost capital (with the danger of blowing their entire account in order to do so), by following necessary money management and strategy rules it would possibly take quite some time to get back on track.

This in turn leads to another problem – the effect on the trader’s psyche and emotions. The greater the size of the drawdown, the greater the stress. And as traders feel increasingly overwhelmed by their poor trading performance, the less likely they are to take the right decisions in order to recover. Once a trader’s individual drawdown tolerance level is breached, s/he may feel increasingly emotionally compromised which may then result in panic and even poorer trade decisions which will likely result in further drawdown and problems down the line.

In order to combat drawdowns effectively, traders would be advised to:

- Establish their own drawdown tolerance level and practice proper risk management procedures accordingly.

- Consider whether and when to take necessary stop-losses in order to safeguard their existing capital available at disposal.

- Avoid using excess leverage or increasing leverage level to recover.

- Avoid over-trading or revenge trading by taking positions blindly simply to recover the trading account.

- Avoid risking too much capital through increased position sizes. The potential increased reward increases the possibility of losing even more money.

- Stick to the initial trading rules and trading plan.

Your trading strategy won’t work all the time due to the ebbs and flow of the market. However, it is essential for traders to accept drawdown as a necessary evil – a normal part of trading where you have not just winning periods but also losing ones. Unfortunately, losing streaks are a regular occurrence but if a trading strategy has a positive expectancy, it is bound to make money in the long term. It is vital to take all necessary steps in order to minimize losses and drawdown as much as possible. By doing so, you are not only protecting your capital, but your confidence and likeliness to go on in the right direction.

There will be plenty of losing periods over the course of one’s trading journey, but how these periods are handled will make the difference between being a profitable trader or running the risk of losing it all.