Are price movements in the market random? Are there any means that exist for exchange traders to realistically make any significant returns in the market? Many would debate favourable arguments for both sides. Exploring the theory of random walk will help us understand better.

Mathematician George Pólya liked to take morning walks in the woods and noticed that he would regularly bump into the same couple. This got him thinking… What is the probability of two randomly walking groups bumping into each other?

Let us first take a look at a random walk in basic mathematical terms:- a mathematical random process that defines a path that consists of a series of random steps on some mathematical space (ex: integers). In our case, random steps in the financial market.

Some main assumptions here in the forex market:

- Markets are random.

- Markets are completely binary — price can only move upwards or downwards.

- There are no other trading costs such as spread or commission.

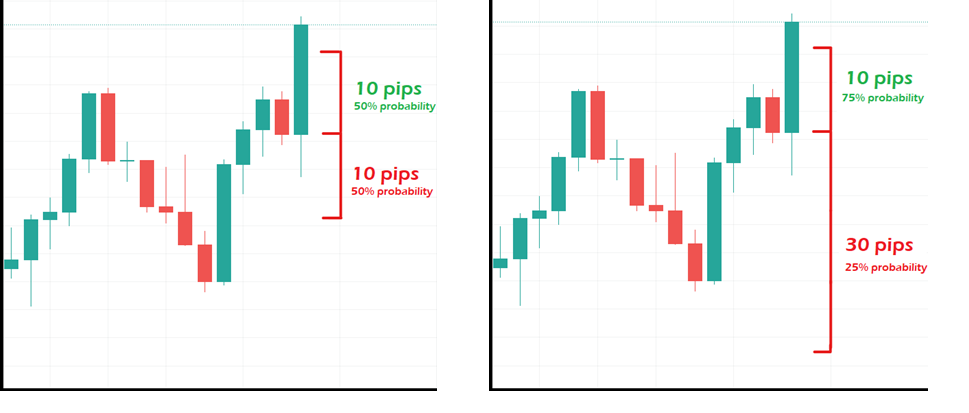

The Random Walk Theory suggests that if there is a 50% probability that a price will rise then there is also a 50% probability that the price will fall.

Let’s take a walk along a random entry with a 10 pip stop and a 10 pip target. Simply put, due to randomness, there would be an equal probability (50% each) of a 10 pip stop or 10 pip target being hit. Alternatively, there is a 75% chance that a 10 pip target would be hit if our stop was placed at 30 pips. Again, this is always going by the assumption that all movements are completely random.

The Random Walk Theory is possibly the most commonly tested hypothesis in empirical literature. It states that prices of a currency, stock or commodity cannot be reliably predicted and are unrelated to their past movements or trends. They move on a random basis in comparison to their intrinsic value. This theory is often connected to the Efficient Market Hypothesis because both theories claim that it’s difficult for most traders to systematically beat the market.

In the Efficient Market Hypothesis prices reflect all the relevant information regarding a financial asset. In the Random Walk prices literally take a ‘random walk’ and can even be influenced by irrelevant’ information.

Both studies suggest it is near impossible to predict future price behavior and therefore it is impossible for a trader to generate any considerable returns through speculation in the long run.

Based on this concept of random walk, three versions of the so-called “Efficient Market Hypothesis” have been developed.

- Weak Efficient Market Hypothesis – the market is efficient in a way that it is reflecting all currently available price information. If there are obvious opportunities for returns, individuals will flock to exploit them until they disappear. Such a hypothesis suggests that technical analysis can’t be used for beating the market but fundamental analysis might be able to.

(Technical analysis is an analysis methodology for forecasting future price direction based on the study of past market data – primarily previous price chart patterns and the use of technical indicators. Fundamental analysis is based on forecasting price direction based on factors such as a region’s economic health, overall state of the economy and other factors such as GDP, employment, production, interest rates, etc…).

- Semi-strong Efficient Market Hypothesis – market participants cannot use technical or fundamental analysis because the market is efficient as it reflects all publicly available information.

- Strong Efficient Market Hypothesis – the market is highly efficient as it is always mirroring the true value of an asset or instrument. There is no way to profit in the market. Not even insider information can help as full knowledge of all aspects and things would be understood by all participants in the market.

Burton Gordon Malkiel’s popular book ‘A Random Walk Down Wall Street’ had a debated contribution to the Random Walk model vis-à-vis the financial markets. Critics with similar views often particularly contest the validity of technical analysis to use previous price movements to forecast the future direction of markets. If the Random Walk Model truly works then this means that all trading strategies and particularly the use of technical analysis will fail in the long run.

Let’s be subjective. Looking at the surface, market charts often do seem totally random. Prices seemingly going up, down and sideways – sometimes making little sense. Some believe that the markets are totally manipulated by those who run it (banks and financial institutions with huge capital and influence on the markets):

– Moving prices up and down in a way that seems fit for their very own vested interests (they are able to do so with the huge amount of capital at their disposal).

– Stop hunting (they look at where the orders are and trade against these orders in the most efficient way possible for themselves).

– Using algorithms (they are able to make use of high-tech computer algorithms that can take trades at exceptionally high frequency).

This is true and is basically a business model they run which produces a consistent profit for them. They have the necessary tools to manipulate the market the best way it suits them.

In some cases, one can argue that this manipulation in itself negates that the markets work completely randomly.

Real experiences, however, often prove the Random Walk theory to be flawed.

The forex market is often labeled as the most efficient market. Although all markets do have a degree of randomness, pro-technical analysts would point out that markets tend to move in wave patterns and not straight lines. These wave patterns tend to re-appear on a continuous basis. Technical analysis practitioners would argue that by relating these repeating laws of price behavior to the market and by using such repeated patterns coupled with the timely use of relevant technical indicators, these can be used to an individual’s advantage to gain signals of profitable entry and exit price points. Other market players argue that a market’s walk is random, but in line with the current trend.

The same can be said for using news and fundamental analysis in order to take advantage of current market prices in order to make a profit. Actual market experiences of traders have shown that people do tend to make extraordinary returns from forex trading, signifying that markets are not efficient and their walks are not random. For example, George Soros is one of the most successful traders in forex history. With a net worth in the billions and having made the majority of his money through moves in the foreign exchange market, many would argue that it is therefore possible to make significant wealth in this field.

Another example, following the dot-com bubble of the late 90s and the global recession in 2008, one could note that $1,000 invested in the S&P 500 from January 1st 2000 to March 1st 2013 would still be worth only about $1,000 (likely less when taking inflation into consideration). Alternatively, during this same period, several forex traders taking advantage of price movement might have been capable of making a profit.

Although the rate of success varies from person to person, successful trading experiences of many traders show that markets are not always random and it is actually possible to predict future movements and make significant gains in the market.