Articles

In the context of trading, money management involves managing your trading capital efficiently and effectively by implementing techniques and strategies to limit risk with the goal of increasing your ...

In forex trading, we often hear about “edge”. It shouldn’t come as any surprise to anyone that if you want to win in forex it doesn’t matter what currencies or timeframes you trade, whether you are a ...

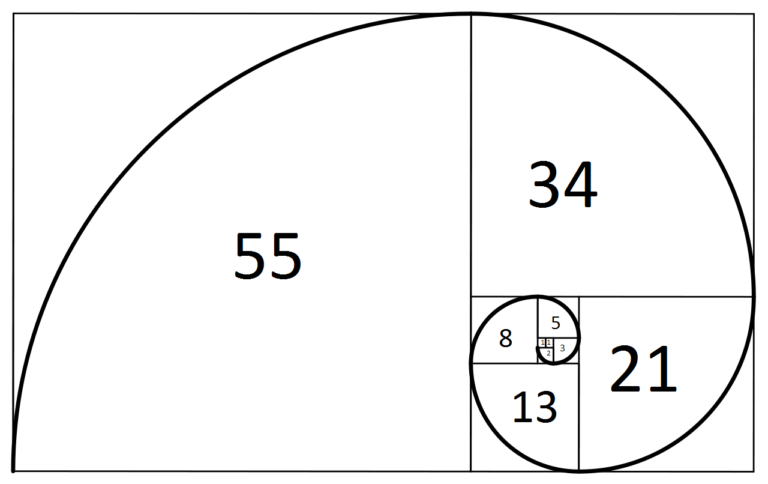

The Fibonacci sequence and Fibonacci ratio have been discovered and rediscovered in various forms – not only in mathematics, but also across various aspects in our everyday lives – including ...

Are price movements in the market random? Are there any means that exist for exchange traders to realistically make any significant returns in the market? Many would debate favourable arguments for ...

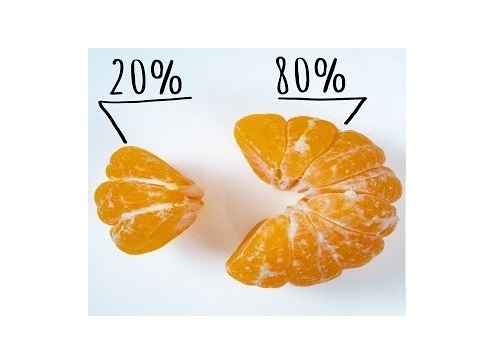

The Pareto Principle, also known as the 80/20 Principle, is a very effective concept in achieving efficiency. Instead of wasting time and resources on unimportant tasks, one can focus on the core ...

There are four main types of market analysis: – Fundamental Analysis – Technical Analysis – Sentiment Analysis – Statistical Analysis There exists a continuous debate as ...

The law of large numbers is a probability theory in mathematics that describes the result of performing the same experiment a large number of times. This theory establishes that as the number of ...

Algorithmic trading, also known as algo trading, involves using computer code to automatically enter and exit trades once certain criteria are met. Algo trading can be used by all sorts of traders – ...